On the 19th May the UK Government announced their UK Global Import Tariff which will apply after the end of the Transition Period to imports from WTO member countries, these may also be referred to as Most Favoured Nation (MFN) tariffs.

The announcement on tariffs followed a consultation period with businesses and trade organisations in which many businesses provided very good input and concepts.

Currently during the Transition Period import tariffs continue to apply based on the European Union Common External Tariff.

The following table highlights the changes that will apply once the UK Global Import tariff commences. It should be noted that these tariffs apply to all WTO members (including the European Union), unless there is a trade agreement between the UK and the WTO member country (or trading bloc). Reduced or zero tariffs can also apply under the Generalised System of Preferences scheme, Duty Suspension or through Tariff Rate Quotas.

| Overall Change in UK Import Tariff in comparison with the EU Common External Tariff -overall 11,828 tariff lines | |

| Tariff Implications | Percentage of Tariff Applicable |

| No change to Current EU Tariff | 33.5% (no change to 33.5% of current products) |

| Liberalised – tariff has been reduced to zero | 16.8% |

| Simplified – tariff band has been rounded down or “banded”. For some complex tariffs, the tariff is now expressed as a single percentage | 40.2% |

| Currency conversion – now expressed in £, previously expressed in € | 9.4% |

| Reduced | 0.1% |

Summary of Changes

There is much to be considered as a result of this announcement, this includes the fact that the UK has significantly reduced a high number of product lines, some to zero and some as part of the simplification processes.

Implications for businesses include the fact that component parts of the manufacturing process are now tariff free including Copper alloy tube or pipe fittings (currently 5.2%) and Screws and bolts (currently 3.7%). Food ingredients and food manufacturing may also benefit from zero tariffs, for example;

- Cocoa Powder not containing added sugar or other sweetening matter (currently 8%)

- Prepared baking powders (currently 6.1%)

There is also the removal of low tariffs below 2.5% (also referred to as “nuisance tariffs”), reducing administrative burden on UK businesses and noting that low tariffs can cost governments more money to collect than the revenue generated.

For the tariff lines that have remained the same, including agricultural products and motor cars, this is in recognition of the need to protect industry in the United Kingdom, but also of the need to protect preferential export status from developing countries which is currently supported through the EU Generalised System of Preferences scheme (and for which the UK will introduce a new scheme on similar terms).

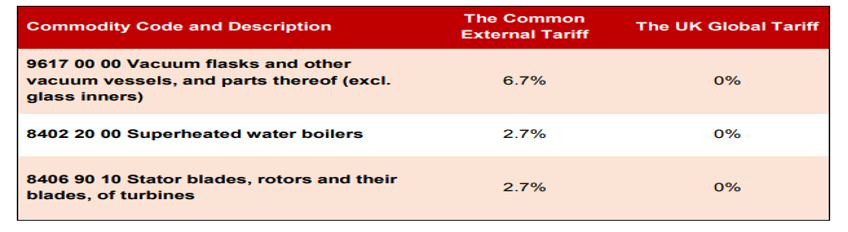

Finally, there is a recognition of the importance of products which have a positive environmental impact and as noted in the table below (source Government paper)

What Businesses Should Do Now

UK businesses, sometimes in conjunction with their overseas supplier should consider the implications of individual tariff lines, considerations should take place in relation to;

- Supply Chain costs

- Supply Chain ‘simplicity’

- Margins and profitability

- Impact on sales potential in the UK, European Union and the Rest of the World

- Competitor activity (linked to location of the national, regional and global competitors)

A key uncertainty however still remains with respect to the UK:EU trade deal, and indeed trade deals that the UK are negotiating with other countries.

Written by Kevin Shakespeare, Director of Stakeholder Engagement at the Institute of Export and International Trade.